Because individual stocks are “influenced” by its respective stock index. Instead, it means you have the “permission” to look for long trading opportunities golden crossover for intraday when the 50MA cuts above the 200MA — a big difference. Because in a range market, the Golden Cross will cause many losses (otherwise known as a whipsaw).

This will allow the trader to make twice as much profit compared to a more conservative trading strategy. The daily chart short the formation of two golden crosses. The first golden cross emerges within the ascending triangle pattern. We can enter a long position when the chart pattern is confirmed using other technical tools or candlestick patterns at the support level. As a lagging indicator, the golden cross may provide limited predictive value for traders and be more valuable as confirmation of an uptrend rather than as a trend reversal signal. As long-term indicators carry more weight, the golden cross indicates the possibility of a long-term bull market emerging.

Three bars breaking a trend

All of these are based on the same concept but have different formulas because of the need to remove or reduce the lag found in simple moving average. We can enter a long at the support level after making sure of the bullish price movement. We define the key resistance level to determine the target profits. The chart below shows the end of a downward market as the 50 EMA moves above the 200 SMA. We then witness a double bottom confirming the upward movement.

Home Depot Stock Price: Will HD Stock Rebound From 52-Week … – The Coin Republic

Home Depot Stock Price: Will HD Stock Rebound From 52-Week ….

Posted: Fri, 04 Aug 2023 17:02:00 GMT [source]

This scenario would likely stimulate a surge on high-risk markets, including the digital assets market. As the value of the U.S. dollar declines, investors might turn to cryptocurrencies as alternative stores of value, leading to a potential rally on the crypto market. The point at which the 50-day MA crosses the 200-day MA from the bottom up is a buy signal.

I made the BEST Moving Average that Disappears in Range Market R…

The first stage requires that a downtrend eventually bottoms out as buyers overpower sellers. In the second stage, the shorter moving average crosses over the larger moving average to trigger a breakout and confirms a downward trend reversal. It refers to a period when the shorter moving average (50 MA) moves below the 200-day MAs. Also, the strategy mostly uses the simple moving average indicator but some traders focus on the exponential, smoothed, and weighted moving averages.

This can give a false sense of the trend direction to traders. The longer the analyzed chart, the stronger and more accurate the signal to buy. As a bullish signal, this particular trading pattern can help determine a possible entry point. Notice that the price range of the candlesticks made a significant jump when the downward trend bottomed out and turned into an uptrend.

Many investors purchase assets when the value of those assets has dropped, but with the expectation that the value will go up again in the future, based on their analysis. There can be many reasons why an asset drops in price, however, that doesn’t necessarily signal a weak asset, but possibly a weak environment. Once the environment corrects, an asset can go up in value. If you manage to buy it on a dip, then you may see a return on your investment.

EMA crosses above SMA

I’m getting so much techniques for trading from your content, thanks you so much Sir for sharing to me. Thank you for this very simple but very effective strategy. Provides just enough instruction to want to try the signature iron cross. However, I would caution against using the Golden Cross to time your entries and exits because you’ll always be one step behind. Yes, the concepts of using the Golden Cross as a trend filter or to trail your stop loss can work on the lower timeframe as well.

Conservative trading, in this case, involves opening a long position after the breakout of the triangle upper border, moving the price higher. This is the final sure confirmation of the golden cross pattern. In addition, the chart shows why it is necessary to wait for the pattern to be confirmed. The most effective moving average values in a golden cross are the 50 EMA and 200 SMA. While the SMA gives equal weight to each value within a period, the SMA places greater weight on recent prices. Therefore, EMA with a short-term value and SMA with a long-term value can deliver the most accurate price direction.

Something likely occurred that changed investor and trader market sentiments at this time. This is a bullish signal that emerges when two moving averages make a crossover. The most common periods of the two moving averages are 50-day and 200-day moving averages. Before a long uptrend started, the RSI indicator signaled a bullish divergence, which is a strong reversal signal at the low of an uptrend.

How Do You Calculate a Golden Cross?

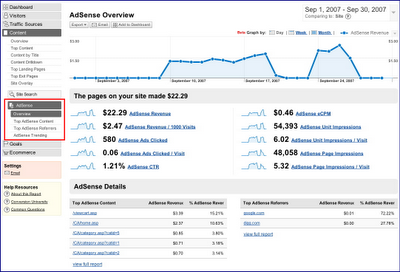

Traders often use a golden cross to confirm a trend or signal in combination with other indicators. Below is full list of stocks which formed a GOLDEN cross on charts in the last 10 days. The list is sorted based on the date when the cross was formed. The first is a correction, where the DXY reverses its upward trend and starts declining.

A golden cross suggests a long-term bull market going forward. It is the opposite of a death cross, which is a bearing indicator when a long-term moving average crosses under a short-term one. All indicators are “lagging,” which means the data used to form the charts has already occurred.

Traders can adjust the time interval of the charts to reflect the previous hours, days, weeks, etc. Generally, larger chart time frames tend to form more powerful, lasting breakouts. There is some variation of opinion as to precisely what constitutes this meaningful moving average crossover. Some analysts define it as a crossover of the 100-day moving average by the 50-day moving average; others define it as the crossover of the 200-day average by the 50-day average. A golden cross is believed to confirm the reversal of a downward trend.

This stage is the key one, as it determines more profitable trade entry points using other technical indicators and candlestick patterns. In contrast, the death cross occurs when a short-term MA crosses under a long-term MA to the downside, indicating a bear market going forward. Both crossovers are considered more powerful when partnered with high trading volume. The golden cross and the death cross are the exact opposites in terms of how they present on a chart and what they signal. The main difference between the golden cross vs. death cross is that while the former indicates an uptrend, the latter signals a downtrend.

Golden crosses and death crosses are used in trading and are a form of technical analysis. A golden cross signals a bull market and a death cross signals a bear market. Both of these are determined by the confirmation of a long-term trend from the occurrence of a short-term moving average crossing over a major long-term moving average. Both crosses help traders in making investment decisions, particularly knowing when to enter and exit a trade. The golden cross pattern is a chart pattern in which the short-term moving average crosses the long-term MA from the bottom up.

- Provides just enough instruction to want to try the signature iron cross.

- It indicates that sellers tried to decrease the price, after which bulls became active to pump the price higher again.

- A death cross is a chart pattern in which a short term moving average crosses below a longer-term moving average, indicating price weakness.

- Once the crossover happens, the longer-term moving average is typically considered a strong support (price decline has halted) area.

- He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses.

- It is the opposite of a death cross, which is a bearing indicator when a long-term moving average crosses under a short-term one.

Summing up, a golden cross pattern is a bullish reversal pattern based on moving averages. You should look for a golden cross when a bearish trend is ongoing. The pattern can appear in any timeframe, including short term MA crosses.

On the daily chart below, we see that that the price of Bitcoin continued to soar after moving above the 50-day and 200-day moving averages. A golden cross is often a false signal in shorter time periods due to market noise. Therefore, it performs better in the timeframes of H4 and longer. At the last stage, the short-term moving average should consolidate above the long-term MA.

Lascia un commento